Apollo Group – Section 172 statement

The AGHL Board has identified the following key stakeholders: capital providers to the Managed Syndicates, Apollo employees, the shareholders of AGHL, Lloyd’s and regulators, policyholders and brokers.

Throughout the year the AGHL Board considered the wider impact of strategic and operational decisions on its stakeholders. Examples include the development and execution of the business plans for the Managed Syndicates; the assessment and raising of capital; communications with capital providers; and changes to board composition. The AGHL Board considers that the interests of all stakeholders were aligned for these decisions.

The support and engagement of capital providers of the managed syndicate’s is imperative to the future success of our business. There are regular meetings with capital providers and members’ agents throughout the year to discuss the performance and future prospects for the syndicates which they support. Feedback received during these meetings enables the Board to factor the views of these key stakeholders into the development of business plans for future years.

Developing and maintaining relationships with brokers and policyholders is central to the success of the Managed Syndicates. Underwriters travel widely with our broking partners to visit clients and attend industry events to promote the syndicates and the Lloyd’s brand and to ensure we continue to provide an excellent service to our policyholders. In developing insurance propositions and marketing them with our broking partners and in settling claims, we always seek to ensure fair customer outcomes and provide products that deliver value.

We maintain open and transparent relationships with our regulators and Lloyd’s, which are managed through our compliance team. Regular meetings are held with representatives of Lloyd’s and the PRA and significant regulatory engagements are reported to the Board.

Apollo’s stated purpose is “Enabling a resilient and sustainable world”. Through 2024 we continued our work to develop and document our ESG principles and standards and assess our current business model against these standards. There is a defined referral process for underwriting risks to adhere to our ESG appetite and manage potential reputational risk. ESG considerations are integrated into the design of the investment strategy and asset allocation decisions, and ongoing attention given to staff engagement, particularly around Diversity, Equity & Inclusion (‘’DEI’’). Further work on ESG activities will continue through 2025.

We have put in place arrangements to assist in managing the financial risks and opportunities associated with the effects of climate change and to ensure that adequate oversight and control of this area in relation to underwriting, reserving, investment management and operations. The business meets the requirements for PRA Supervisory Statement 3/19. Whilst the Chief Risk Officer retains overall accountability for coordinating the approach and effectiveness within The Group, the responsibility is allocated to relevant managers of each business area. Further developments to ensure management of the risks and opportunities will continue through 2025.

Employee matters

We believe that our people are our most valuable asset. Attracting, retaining, and nurturing talent is essential to our success. We are committed to creating a work environment where employees feel engaged through communication, acknowledgment and ongoing growth opportunities. We actively support and promote Diversity, Equity and Inclusion (DEI) as well as mental health and wellbeing to ensure that all staff members feel appreciated, supported and can perform at their best. We function as a team where respect and collaboration are standard practices. Our hybrid working aims to empower employees with shared values and to encourage a culture of communication. We have channels for staff to express their concerns and to share feedback making our workplace safe, encouraging and innovative. Apollo’s people practices remain highly competitive in the London Insurance Market, providing compensation, benefits, and terms designed to attract and retain top talent. A key focus is on ensuring our employees perform at their best with opportunities for skill enhancement, have ability to grow their capabilities and advance their careers within Apollo, this is an integral focus of our succession planning strategy.

Business operations

The Group aims to maintain a lean, efficient operating model utilising technology and outsourcing arrangements enabling flexibility and scalability to meet the demands of the business. We continue to invest in resources across the business in order to ensure that there is an effective operating model and robust three lines of defence model. Lloyd’s Market Blueprint Two initiatives offer several processing efficiency gains for the market, and we believe we are well positioned to adopt the new digital services to maximise the benefit to The Group, its syndicates and its capital providers. The Group continues to successfully maintain a hybrid working environment with all employees able to work effectively, both remotely and from the office, with suitable access to business systems. Aligned with the FCA’s and PRA’s Operational Resilience and Third-Party Oversight policies, Apollo maintains a disciplined approach to operational resilience. We continue to focus on ensuring we maintain robust and resilient plans to prevent, adapt, respond and recover from operational disruptions with the primary objective to protect our customers and the integrity of our business.

Environmental, social and governance

Apollo’s Board approved Environmental, Social and Governance (ESG) strategy was reviewed in November 2024. The Apollo Board drives the strategy, which is aligned with our vision statement and purpose; “enabling a resilient and sustainable world”. Apollo’s ESG Committee reports directly to the Executive Committee and coordinates ESG-related activities within Apollo. The ESG Committee’s mandate is set out within Apollo’s ESG Policy implemented in May 2024, but at a high-level seeks to identify areas of improvement and to ensure progress against the ESG strategy as approved by the Board. Apollo is committed to a long-term sustainable approach to protecting the environment, balancing environmental considerations and social responsibility with our overall business goals. Apollo’s underwriting and investment practices are governed by ESG risk appetites that were originally implemented in 2022 and are reviewed at least annually. Apollo is also working to identify new opportunities that support the transition to a low carbon sustainable economy, including through Lloyd’s new Transition TCX class.

The ESG strategy is reviewed by the AGHL Board annually. During 2024, Apollo’s key achievements have included:

- Integrating climate risk formally into the Enterprise Risk Management and governance frameworks which included enhancements to climate related stress and scenario testing.

- Implementing new Investment Guidelines to avoid investing in sectors that do not align with the ESG risk appetites.

- Joining the Partnership for Carbon Accounting Financials (PCAF) and commenced work to baseline ASML’s insurance-associated emissions; and

- Enhancing ASML’s approach to managing ESG risks in the underwriting process.

At Apollo our people are at the heart of everything we do. We operate a zero-tolerance policy to bullying, harassment, and discrimination. This includes protected characteristics under the Equality Act of 2010, as well as neurodiversity, parental and caring responsibilities, socio-economic status, and working patterns.

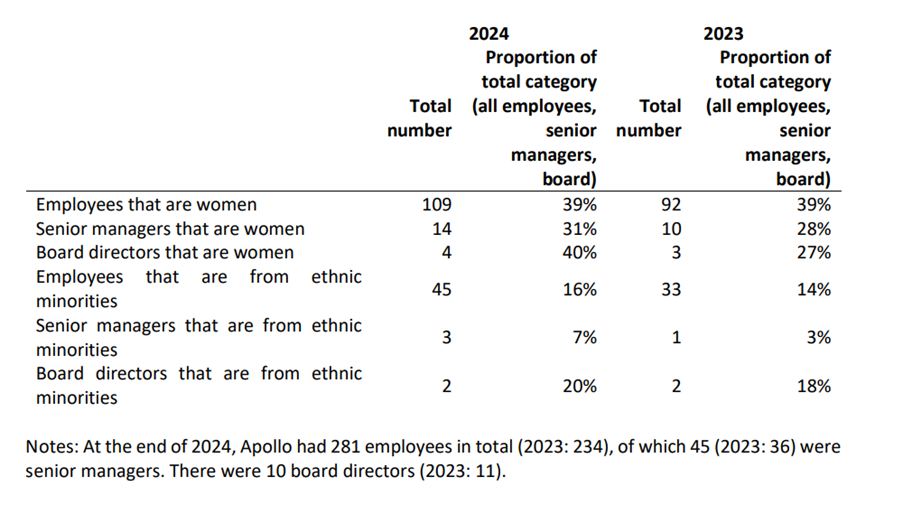

Apollo is dedicated to fostering a diverse, equitable, and inclusive workplace, with a focus on inclusive hiring practices. We are proud sponsors and supporters of six Lloyd’s market inclusion networks. As such, we have implemented several inclusion initiatives and have a comprehensive Diversity, Equity, and Inclusion (DEI) strategy in place. Employees have access to mental health and wellbeing resources through independent partners, as well as additional support through private medical services and the Medicash cashback plan. Apollo monitors gender and racial diversity metrics, employee satisfaction, and governance related metrics. This information is used by the AGHL Board to track progress against the ESG Strategy. Several DEI related metrics at year-end 2024 are summarised below.

Apollo Corporate member subsidiaries:

Section 172(1) Statement

The directors have considered the matters set out in Section 172(1)(a) to (f) when performing their duties and comments as follows:

a) The Company continues to operate in the Lloyd’s insurance market. The majority of its activities are carried out by the syndicates on which it participates. The Company is not involved directly in the management of the syndicates’ activities, as these are the responsibility of the Managing Agents.

b) Other than the directors the Company has no employees. The directors do not receive any remuneration from the Company.

c) The Company’s only suppliers are those who provide services for the administration of the Company. The directors ensure supplier invoices are paid on time in line with any agreed terms.

d) The Company’s operations do not by their very nature produce significant environmental emissions.

e) The Company and the syndicates are required to operate within the guidelines and code of conduct of the Lloyd’s market. Behind the Lloyd’s market is the Lloyd’s Corporation, an independent organisation and regulator that acts to protect and maintain the market’s reputation and provides services and original research, reports and analysis to the industry’s knowledge base. The directors ensure compliance with relevant requirements and promote high standards of business conduct.

f) The directors work very closely with the Members of the Company to discuss all significant decisions including the level of participation on the syndicates.